A recent reminder of a 2020 study from the London School of Economics reveals that decades of tax cuts for the wealthy have failed to benefit anyone but the rich. Despite claims that ‘trickle-down economics’ would help the middle and working classes, the reality shows a different story.

Study Findings: Tax Cuts Widen Wealth Gaps

In 2020, David Hope from the London School of Economics and Julian Limberg from King’s College London studied 18 affluent countries, including the US and Australia. Their research found that tax cuts only allowed the rich to grow wealthier, with incomes for the wealthy rising more quickly in countries with lower tax rates.

These tax cuts not only failed to benefit the middle class but also worsened income inequality, furthering the divide between the rich and everyone else.

Historical Evidence Challenges Tax Cut Justifications

Julian Limberg, a co-author and public policy lecturer at King’s College London, explained, “Our research suggests the economic case for keeping taxes on the wealthy low is weak.” He added that historically, high taxes on the rich, as seen in the postwar era, coincided with strong economic growth and low unemployment rates.

Trump’s Policies Stir Up Debate

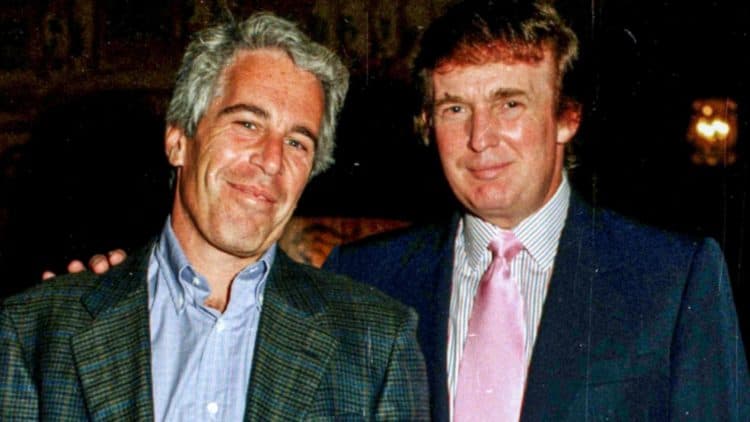

As Donald Trump starts his second term, reminders of this study are resurfacing. Trump’s tax-cut agenda is expected to benefit the wealthy even further, as evidenced by the $64 billion boost to the wealth of the world’s ten richest people, many of whom are US tech billionaires.

On the campaign trail, Trump promised to eliminate federal income taxes in favour of tariffs and remove taxes on Social Security benefits, tips, and overtime pay. However, according to Rolling Stone, if history is any guide, the main tax policy likely to be enacted is yet another significant tax cut for corporations and the wealthy.

You may also like: Led By Donkeys film exposes how Musk’s influence helped secure Trump’s victory